Probiotics inhabit the intestines, competing with bad bacteria for receptor sites. As more good bacteria adhere to the receptors, bad bacteria have less room, resulting in better gastrointestinal (GI) health, generally. However, emerging research suggests probiotics, especially lactic acid bacteria (LAB), affect many other types of cells and chemicals in the body including bile, carcinogens and white blood (immune system) cells.

Mary Ellen Sanders, Ph.D., from Dairy and Food Culture Technologies, recently reminded probiotics marketers, even if science supports a particular benefit, FDA does not allow marketers or retailers to claim probiotics reduce the risk of disease (cold, flu, GI infections, etc.), manage symptoms or improve therapeutic outcomes. She further noted there is no qualified health claim for probiotics, so marketers, including retailers, are stuck with structure-function statements and third-party literature.

Sanders touched on the educational challenge between marketers and consumers, relative to the pitch on what probiotics can do to better health. When marketers say probiotics “balance” intestinal microflora, does the consumer fully understand what “balance” means, she asked. Does it mean balancing microflora after a challenge (stress, drugs, illness), or does it mean to bring microflora back to a “normal” composition? What composition is ideal? Increasing lactobacilli and bifidobacteria may be helpful, but is that balance?

David Sprinkle, research director for Packaged Facts, which reported sales of probiotic/prebiotic foods and beverages topped $15 billion in 2008, a 13-percent increase over 2007, said the challenge for functional products will be how to combine key ingredients, benefits and functions, and product formats in ways that make instant, intuitive sense, as opposed to just piling on nutrients and claims.

In fact, many recent probiotic functional food failures have been credited to lack of delivering a clear benefits message to consumers, although not tying dosage and strain type to existing research can also doom a condition-specific product. The fall-out from probiotic product failures and negative press can also make it tough for retailers to sell the high-quality, effective probiotic products.

Tim Gamble, senior vice president of sales and marketing for Nutraceutix, noted dietary supplements deliver probiotics in far greater numbers and with vastly superior viability than is possible in probiotic-infused foods or beverages. “It is a worry that test results demonstrating this [performance gap] may shed a negative light on probiotics,” he said. “The key for the probiotics industry is to emphasize that, in these cases, the problem is not with the probiotics, but with the poor formulation and unfounded marketing claims made by producers of these food and beverage products.”

Technologies such as Nutraceutix’s LiveBac®, which extends shelf-life and BIO-tract®, a controlled release that protects from stomach acids, are examples of advantages of dietary supplement tablets and capsules over functional foods and beverages.

However, it is a reasonable conclusion that the increased demand from the mainstream consumers, a rise often credited to recent boosts to yogurt marketing, is a clear signal consumers are looking for alternatives to traditional tablets and capsules. One development that might fit the bill is a chewable probiotic.

It took seven years of repeated failures to develop the Vidazorb chewable probiotic, according to Frank Hodal Jr., founder and CEO. “We set out to create a viable chewable probiotic that had long shelf life and didn’t require refrigeration,” he explained, noting the end goal was a chewable tablet that not only delivered live bacteria, but that tasted great too.

This chewable is available for both adults and children, which highlights another aspect of the strain and dosing challenges in selling probiotics. If an adult consumer is unsure how much of what kind of probiotic they need for themselves, how much more confused would they be when buying for a child?

“We formulated Belly Boost™ specifically for children, and the probiotic strains used S.thermophilus, TH-4™ and Bifidobacterium, BB-12®, have been shown to be especially effective for children,” Hodal said, noting the probiotics helped settle stomachs and reduce diarrhea in many children. “However, it helps adults in much the same fashion, though I would recommend larger doses for adults.” He added it’s hard to differentiate between adult and children when it comes to probiotic strains. “They all seem to have the potential to help us all, literally from the womb on.”

By the Skin and the Teeth

Just as probiotics have gone beyond the digestive barrier into immune and inflammatory health, the product format expansion has included probiotics for oral and skin health.

Oragenics developed a probiotic mint (EvoraPlus®) to fight dental decay and bad breath; the product features the company’s Probiora3 branded probiotic blend—Streptococcus oralis (S. oralis KJ3™), Streptococcus uberis (S. uberis KJ2™) and Streptococcus rattus (S. rattus JH145™). Nutraceutix also developed a probiotic mint for oral health benefits, and several companies have brought probiotic gum to the marketplace.

Probiotics in skin care act a bit differently. According to Natasha Trenev, president and founder of Natren, FDA does not generally allow for the presence of any living microprobes in a skin care preparation. “The manufacturer must obtain clearance from the FDA before a level of living microorganisms would be allowed in a skin cream,”she noted, adding Natren markets a face mask kit that contains a live probiotic bacterial freeze-dried culture that is mixed with a clear Aloe vera gel before application.

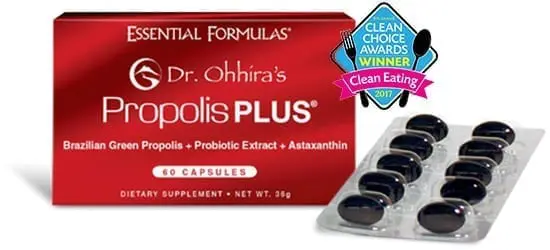

Muneaki Takahata, Ph.D., a microbiologist working in Japan with Iichiroh Ohhira, Ph.D., founder of Dr. Ohhira’s brand probiotics, noted “living” lactic acid bacteria (LAB) are not present in Dr. Ohhira’s skincare product line. “A variety of plants, mushrooms, fruits and vegetables are fermented using 12 strains of LAB for three years,” he explained, noting the resulting fermented medium is called a “fermented extract” in Japan. “It is this ‘fermented extract’ (which contains probiotics, prebiotics, organic acids, bacteriocins, enzymes, and vitamin, mineral and amino acids by-products) that is blended into Dr. Ohhira’s skincare products.” He clarified LAB are present in the “fermented extract” stage, but heat during the subsequent product processing kills off most of the LAB. “However, as research from the University of California, San Diego (in cooperation with an Israel counter-part university), has established, dead carcasses of LAB are beneficial to the human body, and in Dr. Ohhira’s skincare products, the dead carcasses are used to stimulate the skin’s immune system.”

The good news for natural products retailers is natural and specialty stores account for the bulk of probiotic sales, holding a 45-percent market share, while food, drug and mass markets hold only a combined 37-percent share, according to Shanahan. The bulk of probiotics are still positioned for as digestive health products, with 56 percent of products sold for general digestive, gut, flora and nutrient absorption benefits. Despite this trend, a wave of immune health probiotic products is possible in the near future.

“Consumers have been told about digestion, but they will want to know the connection between the immune system and the digestive tract,” Trenev said. “ If 70 percent of one’s immune system is found in the digestive tract, it stands to reason that the 100 trillion bacteria lining the 27 feet of our digestive tract can have a major impact on our immune function: whether it is to up regulate (build defenses) or down regulate (minimize allergic, inflammatory and auto immune diseases).”

Additionally, the functional product market is still active, despite the challenges it has faced in delivery and connecting with consumers. In fact, Shanahan’s data reveals the U.S. consumer probiotic beverage market is expected to grow at a compound annual growth rate (CAGR) of more than 15 percent between 2009 to 2015, with the dairy-based drink category as the largest beneficiary.

The key for retailers will be in understanding the pros and cons of various product formats (shelf-life, storage requirements, etc.) and the research behind various strains (mechanism of action linked to exact study population), and being able to apply this knowledge to the art of not only stocking the best products, but also matching each consumer with the right product and the right message.

“Consumers are now realizing they can choose a probiotic product based on benefit, convenience, price, effectiveness, delivery system, clinical research and other factors,” said Roger Braun, marketing director at Sedona Labs.

How Product Knowledge is Proving to Increase Sales!

Knowledge is power, and for retailers, product knowledge can mean more sales. It isn’t easy to effectively sell to a customer if you cannot show how a particular product will address their needs. Sales associates understanding how the product is made, the value of the product, and how the product should and can be used to raise the bar and keep your customers coming back.

In January, we introduced you to ExpertVoice, a company that understands knowledgeable sales associates influence consumers’ purchasing decisions. Educated staff with personal experience and product understanding are the authority that customers count on to keep them informed about the best natural products, which means their knowledge serves as a trusted conduit to good health.

Through its interactive format, you become a trusted “Expert Voice” by engaging with the content that allows your recommendations to turn into sales that build customer satisfaction and loyalty! Associates who participate with ExpertVoice sell 87% more than their peers. Those who passed a brand course sold 9.5% more after completing the training while gaining exclusive access to products at incentive pricing!

Oliva Mazza, Wellness Department Manager at Be Natural Market in Boone, North Carolina, has used ExpertVoice in the past for other products and, more recently, learned about Dr. Ohhira’s Probiotics. “I found ExpertVoice a beneficial tool when I first started working in this industry seven years ago,” said Ms. Mazza. “I use the easy to navigate training modules to expand my knowledge of supplements, and the free samples are a great way to try the product and share recommendations with customers, which has, in turn, increased sales.”

It’s surprising to find out how many salespeople don’t know a lot about the products or services they sell. It is estimated that, in retail sales, 3 out of 4 times,i the customer knows more about the item than the salesperson does. In many instances, the salesperson knows their product is “good” or possibly “the best,” but they can’t say too much more about it.

This roadblock to sales and, ultimately, customer satisfaction can be eliminated by using the ExpertVoice app or web-based module. Sales staff learn more about the products and enjoy free samples and VIP pricing on top brands, including Dr. Ohhira’s Probiotics, so that they can try them and relay their experience to customers as well as leave reviews online.

Samantha Gladden, a supplement sales associate at Be Natural Market found the training very useful, especially when companies introduce new products or crucial information that helps explain the advantages, such as with Dr. Ohhira’s pre-and postbiotics and the benefits of fermentation. “I enjoy being able to learn about products and then pick which ones work best for my lifestyle. I can then try it and relay my personal experience to customers,” said Ms. Gladden. “All the information on the modules is very beneficial and valuable to relay to customers.”

Ann’s Health Market in Dallas, Texas, Manna Jeans in Springfield, Missouri, and Sawall’s Health Food in Kalamazoo, Michigan, have also reported positive feedback from sales associates participating in ExpertVoice and seen increased sales and positive branding for the product and the store.

“Everyone wins when sales staff are educated on the supplements; the customer, the retailer, and the brand,” said Christine Alardin, a sales associate in vitamins at Ann’s Health Market.

In today’s world of innumerable buying choices, consumers need voices they believe to be authentic! If your store is not already participating in ExpertVoice, log in and experience what it’s like to be valued for your expertise! Download instructions and an easy-to-reference flyer to get started!

Strengthens Communication Skills

Having a thorough understanding of the products on the shelves can allow a retailer to use different techniques and methods of presenting the product to customers. Stronger communication skills will allow a salesperson to recognize and adapt a sales presentation for the various types of customers. One of the questions you should always be asking yourself is “are my employees talking or communicating?” Too many times, they are just talking. Train your employees to sell the benefit and not the features.

Boosts Enthusiasm

Seeing someone completely enthusiastic about a product is one of the best-selling tools. As you generate excitement for the product, you remove any uncertainty the product may not be the best solution for that customer. The easiest way to become enthusiastic is to truly believe in the product. Remember, the first sale you make is yourself; the second sale is the product. If they believe in you, they will believe in the product you are selling.

Grows Confidence

If a customer isn’t fully committed to completing a sale, the difference may simply be the presence (or lack) of confidence a salesperson has towards the product or towards his or her knowledge of the product. Becoming educated in the product and its uses will help cement that confidence.

Assists in Answering Objections

Objections made by customers are really nothing more than questions. If they object to a product, it is likely either you chose the wrong product or the customer needs more of your product knowledge to know why it is the best solution for them. That information usually comes in the form of product knowledge. Being well versed in not only your products but similar products sold by competitors, allows you to easily counter objections.

i Training For Success: Product Knowledge is Power